Many people don't understand the difference between these two schools of economic thought. Nor do people generally care. I don't blame them. I was one of them a few years ago. In order to make any meaningful recovery from the current economic crisis, I think it is very important to understand the differences. Most of our traditional schooling and mainstream media indoctrinates the Keynesian point of view. My interest has been in questioning what if the Keynesian view is wrong, and if the Austrian view is right. What would that mean for our country's future?

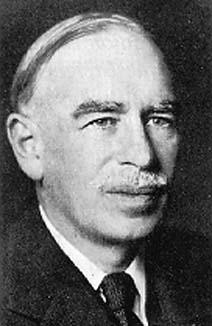

Simply stated, Keynesian economists believe that if decisions were left to the private sector (i.e. anything not controlled by the government), it would lead to economic havoc. Therefore, they believe that monetary policy (i.e. controlling the supply, availability and cost of money) should be managed, primarily through the setting of interest rates, as determined by the Federal Reserve. They further believe that government intervention (i.e. stimulus, bailouts, policy setting) is necessary and that deficit spending (borrowing and spending money we don't have) is acceptable and sometimes necessary. It is the belief of Keynesians that this intervention helps to smooth the business, or economic, cycles. The theory gets its name from John Maynard Keynes who wrote a book published in 1936 called The General Theory of Employment, Interest and Money.

Simply stated, Keynesian economists believe that if decisions were left to the private sector (i.e. anything not controlled by the government), it would lead to economic havoc. Therefore, they believe that monetary policy (i.e. controlling the supply, availability and cost of money) should be managed, primarily through the setting of interest rates, as determined by the Federal Reserve. They further believe that government intervention (i.e. stimulus, bailouts, policy setting) is necessary and that deficit spending (borrowing and spending money we don't have) is acceptable and sometimes necessary. It is the belief of Keynesians that this intervention helps to smooth the business, or economic, cycles. The theory gets its name from John Maynard Keynes who wrote a book published in 1936 called The General Theory of Employment, Interest and Money.  Austrian economists, on the other hand, believe that the major booms, and associated busts, of the business cycle are caused by the manipulation of interest rates. They believe that interest rates provide business owners the necessary signals as to whether they should be expanding their business, or not. A low interest rate would signal that people are saving, not spending. When people are saving, there's lots of available money to lend, which creates competition and drives the interest rate down. On the other hand, a high borrowing rate of interest would signal that people are spending, not saving. If people are spending, it takes a much higher interest rate to encourage them to not spend their money. So if an interest rate is artificially set too low, businesses perceive that consumers are saving, not spending. Therefore, they embark on expanding their businesses in order to meet a perceived future demand. That is, if consumers are not spending today (because they are saving) they will be spending in the future. So in order to meet the future demand, they build more factories. They higher more people. This creates an artificial growth or "boom" period. Eventually, when it is exposed that consumers really didn't need all those extra products or services, a correction or "bust" period needs to occur in order to cleanse the malinvestments made during the boom period. The Austrian school gets its name from some of the early Austrian founders, most notably Ludwig von Mises.

Austrian economists, on the other hand, believe that the major booms, and associated busts, of the business cycle are caused by the manipulation of interest rates. They believe that interest rates provide business owners the necessary signals as to whether they should be expanding their business, or not. A low interest rate would signal that people are saving, not spending. When people are saving, there's lots of available money to lend, which creates competition and drives the interest rate down. On the other hand, a high borrowing rate of interest would signal that people are spending, not saving. If people are spending, it takes a much higher interest rate to encourage them to not spend their money. So if an interest rate is artificially set too low, businesses perceive that consumers are saving, not spending. Therefore, they embark on expanding their businesses in order to meet a perceived future demand. That is, if consumers are not spending today (because they are saving) they will be spending in the future. So in order to meet the future demand, they build more factories. They higher more people. This creates an artificial growth or "boom" period. Eventually, when it is exposed that consumers really didn't need all those extra products or services, a correction or "bust" period needs to occur in order to cleanse the malinvestments made during the boom period. The Austrian school gets its name from some of the early Austrian founders, most notably Ludwig von Mises.Keynesian economics, therefore, tries to manage the business cycle with the assumption that the free market could not determine how to set an appropriate interest rate. This, of course, is completely ridiculous. As a quick example, suppose there was a remote island with just three people living on it. Two of them had money to lend and one wanted to borrow money. You could easily imagine how competition between the two lenders would establish an appropriate interest rate to charge the borrower. The same thing would happen in the real world, probably even more efficiently since you'd have millions of lenders competing against each other on a daily basis.

Austrian economists recognize that the complexity of human behavior makes mathematical modeling nearly impossible and recommends a "hands-off" or non-intervention approach. They believe that the intervention in the markets is what causes the business cycle in the first place.

Have I lost you yet? No? Good. The above is obviously a very simplistic overview as volumes of literature have been written on these economic theories. However, to enjoy this really cool Rap Video called "Fear the Boom and Bust" which came out a few days ago, the above context will be helpful. John Maynard Keynes (Keynesian) battles F.A. Hayek (Austrian) on the merits of their economic theories. Pretty geeky, yeah. But still cool.

In the video, rapper Keynes says "C, I, G altogether gets to Y". And still being a student of economics (does anyone ever graduate?) I scratched my head. That's not a formula that I use on a daily basis, or even remember. So I learned that GDP, or Gross Domestic Product, is sometimes referred to as "Y". GDP is a basic measure of the country's overall economic output. It is the value of all the goods and services made within the country in a year.

And the formula refers to the components of GDP. The "C" is for consumption or things that we buy and consume such as food, clothes, gas and medical care. The "I" is for investment in plant, equipment, inventory and structures, including houses. And the "G" is for government spending including paying all government employees and military spending.

No comments:

Post a Comment